One of my favorite Seinfeld episodes is called “The Opposite.” In it, George (the perpetually unsuccessful main character) realizes that every decision he has ever made has been wrong, and that his life is the exact opposite of what he wanted it to be. His successful friend Jerry convinces him that if every instinct he has is wrong, then the opposite would have to be right. That feels pretty logical and George goes on to experiment with doing the complete opposite of what he would do normally. I won’t tell you what happens so as not to spoil it for you, but the basic concept from my favorite sitcom applies to investing.

The average investor tends to buy stocks when they are going up in price and tends to panic and sell when they fall. That is a very natural human behavior. However, it is not what leads to wealth creation. In fact, this basic behavior is probably what holds back most people who are actually on the right track (after all, not everyone even decides to save money to invest). There is a lot of literature on this but basically, the reason this holds people back is they tend to buy stocks when they are relatively high and sell when they are relatively low.

While the opposite strategy would be optimal, nobody can perfectly predict the highs and the lows. That’s why I tend to invest all the time (there has not been a month when I didn’t invest in at least 12 years but more likely in about 20 years). It’s not because I am so privileged that I can do this. I’ve invested various amounts, sometimes only a few hundred dollars in a 401k. It’s all about the discipline that helps me ultimately get the average price through time (not relatively low or high). I’ve written about dollar cost averaging in past posts (for example, here).

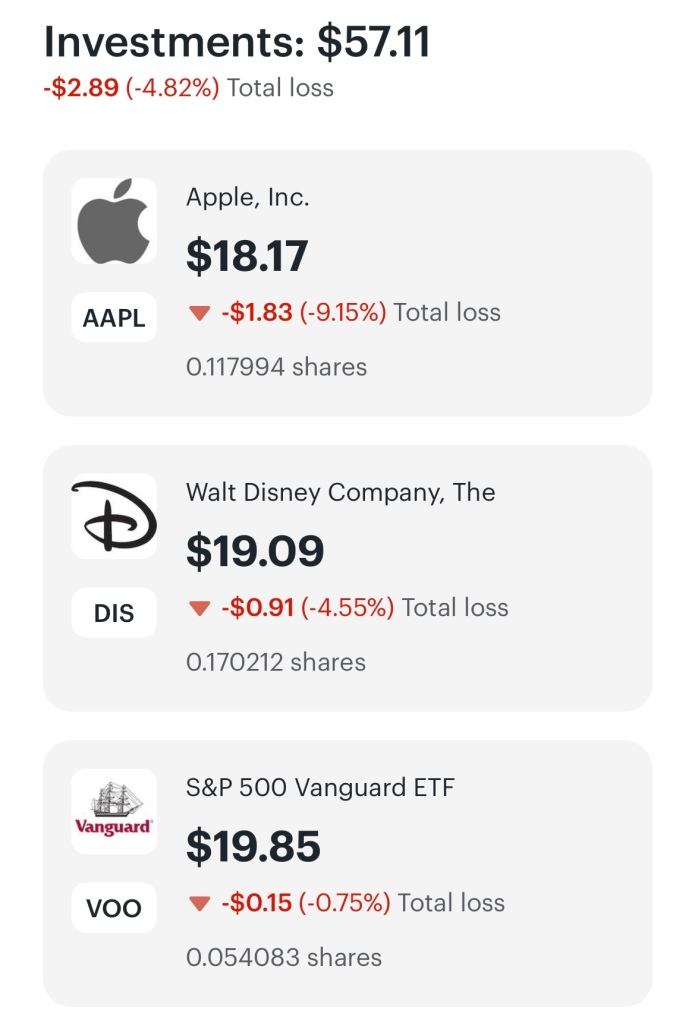

But this post is not about dollar cost averaging. I held back against my instinct to invest everything I had during the stock market party of 2021. Instead, I continued dollar cost averaging some money every month and holding some cash on the sidelines. I held off some cash so I can do the opposite of most people’s instincts. Most people sell during the “selloff,” when the market seems to be in free fall with the looming recession, Federal Reserve is steadily increasing the interest rate, and a major war is happening in Europe. I won’t perfectly find the bottom and I am not trying to. I’ve just increased the size of my monthly investments to make sure I get more of the “discounted” prices. I am still dollar cost averaging, but I am doing more to bring down the average.

For me, this is the time to put more of my cash to work. Like Warren Buffett, I expect to be a net buyer of stocks over the course of my life, which means I plan to buy more than sell. That means, I generally like it when stocks experience declines in price in the same way a shopper likes to shop during holiday promotions. As Mr. Buffett would also say, the world has gone through many selloffs and all kinds of calamities, but the stock market continues to grow when you zoom out far enough.

It’s a scary time for sure and I will most likely continue to see my portfolio go down in value. But 5-10 years from now and maybe even sooner, I will be glad I followed Jerry’s advice to “do the opposite.”

Here is a clip from that Seinfeld episode for further inspiration and a laugh.