I want to illustrate the power of buying and holding. As Warren Buffett says, “our favorite holding period is forever.”

I also want to talk about buying household names that you know and understand. This idea that you can invest in companies whose products and services you use every day is something popularized by Peter Lynch, who is one of the most successful investors of our time (he managed the Fidelity Magellan Fund to an average annual return of 29.2%, making it the best-performing mutual fund in the world at the time). His philosophy was “invest in what you know,” and it’s actually very similar to the idea of investing within your “circle of competence,” which was popularized by Warren Buffett.

Onto my illustration… Microsoft and Meta (formerly Facebook) reported their quarterly results yesterday. Those results were very good for both companies, and so their stock prices jumped during the next trading day (Microsoft was up ~4% and Meta was up ~12% at some point during the day).

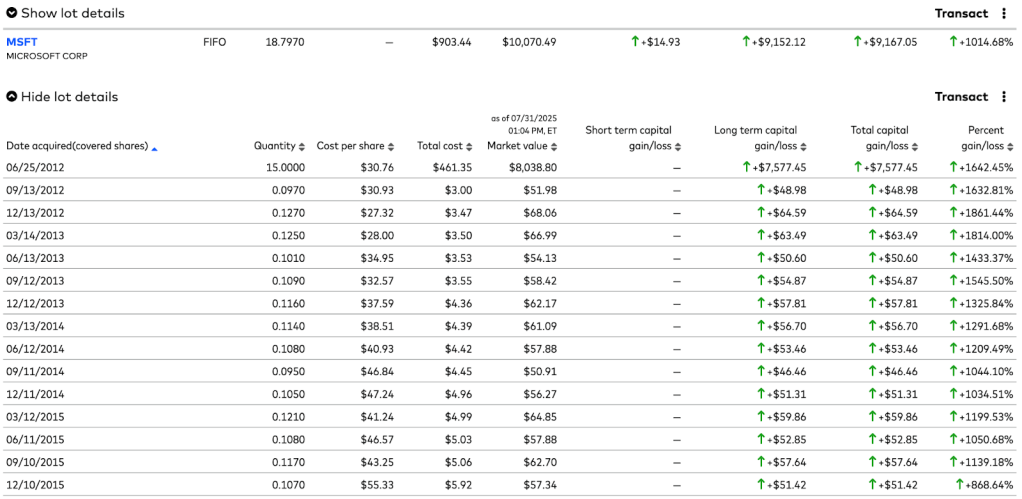

Well, roughly 13 years ago, as a regular happy user of the products of both companies, I happened to purchase some shares in both of these companies (15 shares of Microsoft and 25 shares in Meta). I also happened to hold these shares and not sell them. As the time went by, Microsoft’s share price increased and it paid out a quarterly dividend, which I automatically re-invested right back into the company. Same happened with Meta, though it only started paying a dividend in 2024.

When I bought Microsoft stock, the shares were priced at $30.76, so I paid a total of $461.35 for the 15 shares. Today, those same Microsoft shares are valued at ~$536 per share and $8K for the 15 shares (up 1,642%). If I include dividends, my Microsoft shares are valued at around $10K. Note that the dividends also grew at high rates.

Meta stock cost $20.28, so I paid $507 for the 25 shares. Today, Meta shares are valued at ~$778 per share and ~$19.5K for the 25 shares (up 3,737%). If I include dividends, my Meta shares are valued at around $19.6K.

Both companies are in the technology space, which is known for high growth. However, Microsoft is a 50 year old company (founded in 1975) and Meta is a 21 year old company (founded in 2004). Though I bought Meta in the year it went public, I bought Microsoft about 26 years after it went public. I wasn’t an early investor in either of these companies. Though I didn’t make retirement money there, I think it’s intellectually exciting to be able to generate a gain of 1,600%+ in a 50 year old company 26 years after its IPO.

This is how a few winners can make up for some duds.

Of course, the market has been very hot and some of these gains are driven by the overall stock market performance. That said, these companies have executed really well, managing existing core business and staying on top of innovation. A lot of people at these companies contributed to this success, but the leaders at the top play a critical role (CEO Satya Nadella at Microsoft and CEO Mark Zuckerberg at Meta).

Thank you, Satya and Mark. Best wishes for the next 12 years.

The point? Well run companies of any age with great leaders and solid business models can produce very exciting results with a bit of patience.

P.S. Don’t forget to automatically re-invest the dividend.

Disclaimer: none of this is investment advice. Please do your own homework and invest carefully and thoughtfully.

Exhibit A: Microsoft transactions (includes some but not all dividend transactions)

Exhibit B: Meta transactions