One aspect of building wealth that I believe is very important is giving money away. I know that it sounds counter-intuitive, but bear with me.

We need money so that we can pay for things, and spending money can take many different forms. One clear aspect of spending is to buy the things that we absolutely need, such as food, shelter, etc. Once you are able to satisfy the basic needs, you can buy things that you want that might not be as critical for your survival (e.g. Netflix subscriptions, etc.). But once you’ve got some needs and wants satisfied, the more rewarding ways to spend money becomes available to you.

More rewarding ways to spend money:

I wrote before about spending money on investments (so that your future self can benefit). You can also put money aside that you would want to give to your kids, if you have them and if you like/love them. That is a form of giving money away, though that still keeps it in your family. The other way of spending money is donating it to people, organizations/causes, that are outside your family.

Philanthropy:

Donating, otherwise known as philanthropy, can be the most rewarding for some. Interestingly enough, some people spend more on this during the course of their lives than on anything else – by far. For example, Warren Buffet famously gave to his kids “enough money so that they would feel they could do anything, but not so much that they could do nothing.” He believes that an inheritance should provide security and opportunity but shouldn’t eliminate the drive to work, contribute, and build a meaningful life. So, 99%+ of Buffett’s wealth is going to the Bill & Melinda Gates Foundation and foundations run by his children.

Is this required?

Nobody is required to donate money, but I think keeping too much for your own consumption or spoiling your kids with too much sounds better than it is. So, if you put yourself on a path of wealth, I suggest you learn about philanthropy. Focus your mind on building so much wealth that you will need/want to give a lot of it away.

Donation opportunities:

Of course, there are all kinds of donation opportunities all around you that can be much more personal than simply giving money to some organization. In fact, I encourage you to be very deliberate and careful with your philanthropy; you don’t want your hard-earned dollars to end up in the wrong hands (e.g. organization that spends money in ways that go against your values or interests). Some practical places where you may donate money that are close to home are your children’s or nephews/nieces’ schools. That is a great way to support the school, enhance their facilities, increase their security, enable socioeconomic diversity, etc. Of course, you can also donate to your alma mater university or graduate school as a way to support learning and research, or as a form of gratitude for giving you what was probably an amazing and foundational experience.

Useful tool to maximize your philanthropy:

Ok, onto the money… One tool for accumulating money for philanthropy is the Donor-Advised Fund. I only wish I learned about it sooner. Basically, the way this works is you can contribute appreciated assets (e.g. public company stocks) to a fund from which you can later donate money to the non-profit organizations of your choice. Why would you do this? You don’t have to pay any taxes on the long term appreciation of that stock price (you must have held it for at least a year), and you can still deduct that donation in full from your taxes.

I think it’s way more meaningful to measure your success by increasing the amount of money you are able to donate every year than by buying more expensive things (external status). Plenty of cultures and religions support this notion and I have to say it really does feel very good to donate and to annually increase giving levels. So, back to the DAF. Let me illustrate how the DAF works and when you might want to use it.

Real life example:

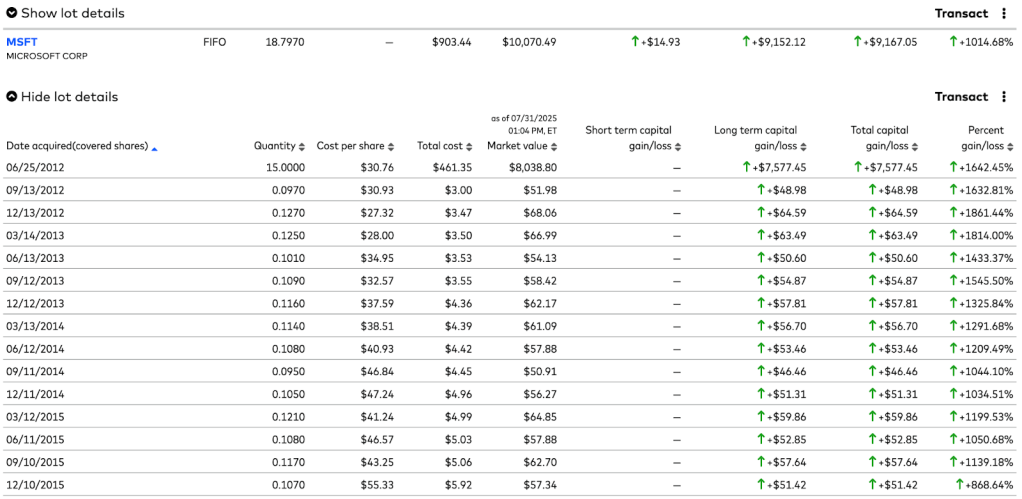

The table below shows my holdings of Robinhood (stock ticker: HOOD). I am a long-time user and have been buying this company’s stock since the IPO. It’s also my way of having some exposure to crypto, without directly buying coins. In any case, you can see that some of my lots have appreciated substantially and I’ve held them for more than one year. The lot with the highest appreciation is the 20 shares that I bought on 6/26/2022 for a total of $137.48 (share price of $6.87). Now each share is valued at $116.64. My long term gain on these shares is $2,195.27. If I sell these shares, I will need to pay taxes on this gain. If I transfer them to my DAF account, I don’t have to pay any taxes on the gain and I can deduct the market value ($2,332.75) from my taxes in the year that I move this into the DAF (I can actually decide where I want to donate in future years). So that’s a good example of protecting from taxes the stock that appreciated 1,596.79%. Why pay the government when I can later donate this money to my kids’s school so they can buy better equipment, etc. I think I can allocate capital better than the government, and though I pay plenty in taxes, I like this tool because it helps me put more of my money to philanthropic work. If I had to pay long term capital gains to the government, I would have paid almost ~$731 since that’s what you get when you pay 20% federal rate and 13.3% state tax in California, assuming high taxable income ($2,195.27*33.3%).

How does it actually work:

Mechanically, you move those long-term appreciated shares to the DAF account. They effectively are no longer yours, but you get to advise that fund where you want those donations to go. For example, if I want to send a donation to my kids’ school, I press a few buttons to recommend the donation to my charity, there is a quick approval process, and the DAF sends a check. That’s it. Non-profit organizations tend to know about this so they welcome this path, knowing that people can donate more. By the way, after you move your stocks to the DAF, the DAF converts them to a diversified ETF that can also grow over time.

Learn more and do it if you want to increase your giving / save some money:

So, if you want to increase your giving by as much as ⅓, I recommend learning more and setting up a DAF at whatever brokerage company you might already be using. I decided to use Schwab, which has been pretty straightforward. Now I love it when my stocks appreciate even more because I get to give more away. By the way, if you currently regularly give to some organization and you don’t want to increase your donation amount, you can think of this as getting a discount because you are donating pre-tax money. Either way, this tool is highly recommended.